Summary

Investment Thesis

The market is valuing this company the wrong way. It seems to have forgotten the company actually has an underlying business and instead labeled it a DAT, something it isn’t. Even if it was just a DAT, it is still trading below book value of around ≈0.60 per share.

Throughout the last year GameSquare has gone through a huge internal renovation divesting two of its largest business FaZe Media and Frankly Media in an effort to improve margins and set up their operating business for profitability. This is something that seems to be working…

At the current price of 0.47, this stock is a strong buy and in a base case I see 300% upside over the next 12-18 months. For this to happen, management just has to meet guidance and this would assume a 3,000 dollar Ethereum value.

If you look under the hood, you can see a strong, healthy operating company whose services are only set to grow in demand. There are risks, but I’m here to address those and tell you this isn’t just a normal penny stock. It’s a fantastic value play that is trading significantly below its fair value.

Overview

Many people misunderstand what Gamesquare does, as a member of Gen Z myself, I can tell you there is no shortage of demand for these services and if brands want to reach younger generations, GameSquare is one of the best options. So first, let me explain what they do.

GAME owns and operates a suite of companies all focused on helping companies connect with young audiences (as well as operating their own esports team). This is done through services like agency, creative marketing, SaaS, and gaming. This is where some people fail to see value. “Gaming” has a stigma around investing which contributes to the uncertain sentiment around the company. The truth and story is, this isn’t a full on gaming company and majority of their revenue comes from other sources.

Majority of revenue includes SaaS, agency, and the new treasury strategy which generates above market yields ACTIVELY. As a member of Gen Z, its easy for me to see the application of this when I come across example of their business in my own life such as an influencer marketing a product, a stream promoting a new game, or a local esports tournament. I’ll go into more detail about each service late but to say the least, these services will only continue to be in demand...

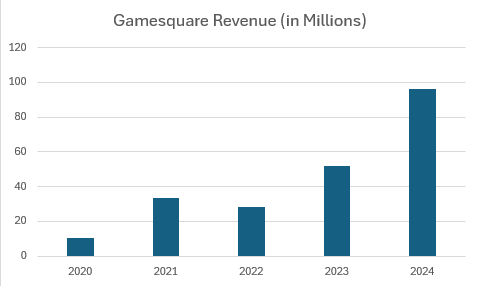

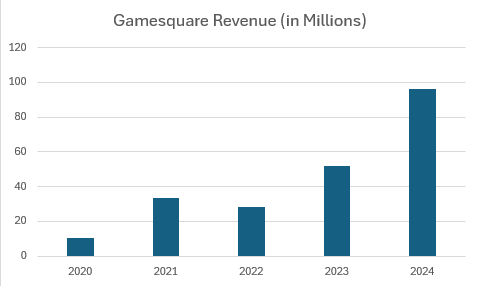

GAME revenue 2020-2024 (Yahoo Finance)

Why Gamesquare isn’t a DAT (Treasury Analysis)

As I mentioned before, this company is not a DAT even though it is being priced as one. So to start, I’m going to point out some differences between traditional DATs and Gamesquare. This includes five things: